[Editor’s Note]The concept of online literature has grown from scratch, and the living environment has changed from being attached to forums to industrialization, but it has only been 20 years. The author of this article, Jin Maniu, is an online author. He started writing for seven years in 2009, and combed the ten-year online literature events he experienced from the perspective of a writer.

Every two years, from Tianying in 2004, 17K in 2006, to 2008, the online literary world ushered in a vertical and horizontal.

Relying on the perfect time and space, which is not inferior to Shanda’s capital, the trend of adapting online games by IP was born. At that time, no one knew what impact it would have on the overlord of the starting point …

In September 2008, the Chinese online line was vertical and horizontal.

"At the beginning of the opening of the Chinese website, dozens of famous online writers, such as Jiangnan, where is it now, Xiao Ding, Hong Xue, Tang Jiasan Shao, Yan Leisheng, Ma Boyong, Wandering Saber, Alcoholic, Ayue, Bucket Rider, Chu Xidao, Bandit I miss my life, White rice is like frost, Yueguan, Jingguan and so on, sent joint congratulations, during which great works were more like Ganges sand, and many magazines and portals were in the planning stage of the website.

Of course, the above are all idioms in the encyclopedia "Vertical and Horizontal Chinese Network".

The so-called joint congratulations are similar to the popular "congratulations from the people of Shandong" and "congratulations from the people of Hunan" at that time … As for the "great works" such as the sand in the Ganges River, it is even more popular.

At that time, the vertical and horizontal Chinese network was far from reaching the level of "starting opponent", let alone "powerful" …

Actually.

In 2008, even in 2009, it doesn’t belong to the vertical and horizontal.

If in 2007, the online community still had expectations for 17K, since 2008, 17K has been unable to launch an impact on the hegemony of the starting point, focusing on the second camp. In the next year or two, the online bookstore changed from a "hegemony" pattern to a stable development pattern.

Although the website of Vertical and Horizontal Chinese has been established in September 2008, during the two years from 2008 to 2009, the vertical and horizontal Chinese website did not set off too much waves in the online world. Originally, in the past two years, I’m going to mention some events worth recording, but I still need to mention them.

The confusing "Sima Incident"

In 2008, the biggest event in the online world was "Sima Incident", also known as "Sima Gate".

Sima: A well-known starting point, with works such as Living Colors Arouse Fragrance, Unifying the Three Kingdoms, and Teaching Assistant of Beauty Class.

According to the information provided by himself, he graduated from Beijing University of Political Science and Law with a bachelor’s degree and a master’s degree in directing from Beijing Film Academy. He has a beautiful girlfriend named Xiao Lei who graduated from acting department. (Author’s Note: However, Fang Hai is not found in the graduation list of Beiying. And 83 years later, there was no such name as Beijing University of Political Science and Law, and it was changed to China University of Political Science and Law. )

On May 12, 2008, after the Wenchuan earthquake, he claimed to go to Sichuan for disaster relief, which was later proved to be a lie.

After self-explosion, he suffered from uremia. But it is still questioned by netizens. In September 2009, Qidian published an obituary provided by Sima’s mother, claiming that Sima died on August 31, 2008 due to illness and treatment. Based on the fact that Sima has passed away, if we make an evaluation of the Sima incident, I am afraid there is only one sentence: hateful people must have pity.

The following is a brief account of the "Sima Incident".

On May 17th, 2008, Sima Yu published the foreign chapter "Pour me a heroic bar! ",claiming to drive six carts and two buses with more than a dozen friends and go to Sichuan for disaster relief.

On the 18th, Sima went to QQ and was discovered by book lovers. The IP address was not in Sichuan, but in Fujian. So I questioned it in the book review area. Sima’s friend’s wandering saber (author’s note: Sima once published a message about a girl suffering from cancer, and Saber donated thousands) called Sima, and Sima’s mother answered the phone twice several hours apart, indicating that she helped to contact Sima, but it was fruitless. When the wandering saber calls again at night, turn it off.

This caused the wandering saber to wonder if Sima was at Fujian’s mother’s place and deliberately didn’t answer the phone.

So the wandering saber called several friends in Chengdu and asked them to look for Sima in the place where Sima claimed to be, but there was no result.

Later, some netizens asked Sima to issue a high-speed bill to Sichuan, but there was no result.

So many netizens denounced Sima.

On May 23rd, under pressure, Sima announced that he was suffering from uremia. And said that he is indeed in Chengdu.

However, this announcement was questioned by netizens. Some netizens contacted friends in the hospital to prove that Sima said that the hospital did not treat Sima. After Sima provided photos of his hospitalization.

However, Sima has completely lost the trust of almost everyone on the Internet, and the wandering saber and other former friends have broken up.

Later, the Sima incident came to an end.

(Author’s Note: I am hesitant and hesitant to write down the above Sima incident. To tell the truth, I still doubt Sima. But in any case, the obituary came out, and I still wrote the Sima incident on the premise that the dust has settled. I also hope that everyone can see the above records of the Sima incident, try not to discuss it again, and let it settle down. )

Ten-year inventory activity of network literature

"From October 29, 2008 to June 25, 2009, under the guidance of the Chinese Writers Association, the 17K website of Chinese Online and Selected Novels jointly hosted the ten-year online literature review activity. This is a grand carnival in the field of online writing since the birth of online writing in 1998. More than 1,700 online works (mainly novels) have participated in or been nominated for selection. The main force of network originality collided with the mainstream literary media, which became the biggest literary event in China literary circle in 2008-2009.

The ten-year inventory activity has built a bridge for the communication between traditional literature and online literature, and it is a milestone event in the development history of online literature in China and even in China. This is the first time that mainstream literature has affirmed online literature, and online literature has since formally entered the stage of China literature. "The above is a brief introduction to this activity in the encyclopedia.

In fact, although the 10-year inventory is a grand activity sweeping the whole online literary world, the entries and the final top ten works also include online novels of various websites, but both the process and the result can’t get rid of the shackles of 17K self-entertainment. In addition, focusing on literary and traditional inventory can’t really objectively show the ten years of online literature development. Traditional literature may have begun to touch online literature, but it has not let go of its arrogance and prejudice.

But we can’t say that the ten-year inventory is a farce, nor can we say that it is a self-promotion after 17K missed the road to hegemony. At least, it was a brave attempt. Even now, as of 16 years, this is an unprecedented attempt. Because after this inventory, the list and inventory of major websites in later generations are more exclusive and more "entertaining" …

The following is the final list of ten-year inventory:

Top Ten Excellent Works: Teenagers Here, Chengdu, Please Forget Me Tonight, New Song, Stealing Ming, Wei Shuaiwang’s Jianghu, Fate of Dust, Home, Zichuan, Homelessness and Facebook.

Top Ten Popular Works: Dust Destiny, Zichuan, Wei Shuaiwang’s Jianghu, Blasphemy, Strange Tales of Urban Demons, Returning to the Ming Dynasty as a Prince, Home, Wu Song, The Legend of Wukong, Lonely Master.

Dream into a trance VS I eat tomatoes.

If we want to choose an annual novel at the starting point or even in the online world in 2009, Sanshao’s Douluo Mainland definitely deserves its name. We can say that Douro is the peak of Sanshao, the largest IP of Sanshao, and even a representative work that Sanshao has established the supreme position.

However, in 2009, the annual drama did not belong to Sanshao, but to two other works of Super God:

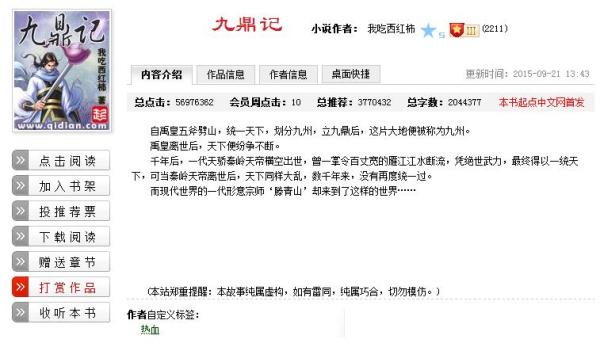

Dream into the machine "Yang Shen", I eat tomatoes "Jiu Ding Ji".

Yang Shen was released on July 27, 2009, and it was a dream. With the momentum of The Romance of the Dragon and the Snake, it was determined to forge ahead, showing us a grand and fantastic fantasy world.

The Jiu Ding Ji was released on July 28th, 2009. I ate tomatoes, relied on the inside information of Star Change and Panlong, and came to the King’s Landing again in the highest name, writing my dreams. Since the release of the two works, they have been playing against each other.

I started eating tomatoes with Inch Mang, and the electronic subscription has repeatedly broken records. There is no need to say more about the strength of Star Change and Panlong. It can even be said that among the "three highest", I ate tomatoes and was the first to be crowned the highest god. Tang Jiasan was also crowned supreme after Dou Luo, and Li Hu was the highest when Dou Break the Sky was invincible.

Compared with my eating tomatoes, the dream-entrancing machine is inferior in e-subscription, but in terms of influence, it is not too much: the founder of Buddhism is the Tao, the leader of martial arts in Dragon and Snake Romance, and the edge of dream-entrancing machine is unmatched! Since the release of Yang Shen and Jiu Ding Ji, these two books have occupied the top two places in the list, except for two works, even Dou Luo, which is better than Tang Jiasan, had to avoid the edge at that time.

This confrontation can be said to be a deliberate arrangement of the starting point. It can also be said that it is a fate confrontation.

"Yang Shen" is like a dream, sharp, amazing and magnificent. Dream into the machine "Buddha is the Tao" is a seal of god, with sharp edges and amazing momentum, which shocked everyone’s eyes. Later, The Old Demon of Montenegro and The Romance of the Dragon and Snake also gave people a feeling of hanging upside down like a knife.

Jiu Ding Ji is just like eating tomatoes. It seems tepid, but it also has strong strength. I ate tomatoes from The Legend of Star Peak to Inch Mans to Star Change, which rose steadily, and my writing style was relatively smooth and gentle. Compared with Yang Shen, Jiu Ding Ji is not mysterious and amazing, and even can only be defined as "high martial arts" in the end, but it is equally fascinating under the style of eating tomatoes, and it can achieve no less subscription results.

In the early days, the two books were evenly matched, and each was good at winning. On the ultimate battlefield monthly ticket list, there are also winners and losers.

Until the end of 2009, in the first half of 10 years, "Yang Shen" ranked first in the world with a monthly ticket of eight consecutive championships, and "Jiu Ding Ji" ended prematurely in April of 10 years after losing several times in a row. It is three months earlier than Yang Shen, and the number of words is also 1 million less. It seems that this battle, tomatoes, I eat tomatoes, became a temporary loser.

The time is temporarily transferred to November 8, 2010, when the dream machine has joined the Chinese website. On this day, The Legend of Immortal Immortality, which started with the great god forgetting his words, achieved the goal of 100 leagues and had 100 champions (author’s note: champions generally refer to readers who spend 1000 yuan RMB in a book). The starting point is to change the total number of fans displayed in the link page of the fan list on the right side of the page from 100 to 200 (author’s note: it was later changed to 500, and the fan inquiry was completely released). At this time, some busybodies found that a large number of adjacent digital accounts appeared on the fan list of the old books "Buddha is the Tao" and "Montenegro Old Demon". When The Buddha Is the Tao and The Old Demon of Montenegro were serialized, there was no fan list at the starting point, and the subscribers had no fan value. These digital fan subscribers obviously appeared later. As a result, people questioned the dream-entrancing machine, thinking that the dream-entrancing machine built a large number of trumpets, obtained monthly tickets by subscribing to old books, and voted for Yang Shen, which made Yang Shen beat Jiu Ding Ji and achieved eight consecutive championships.

There seems to be a layer of dirt on the dazzling body of Yang Shen.

Author’s comment: When Yang Shen comes out, who will compete with him? When the magic machine comes out, who will compete with it? In fact, I have been thinking about it for a long time, and I am reluctant to use the word "who is fighting with the front", because it will expose the scarcity of my vocabulary and my LOW. But I have to say that when it comes to magic, I can’t avoid the word "edge". Yang Shen can’t be said to be perfect. Up to now, there are still many book lovers who criticize the decline in the quality of Yang Shen in the middle and late stages, and the achievements of Yang Shen can’t be said to be impeccable. However, no one can deny the amazing nature of Yang Shen and the talent of dreaming. It is no exaggeration to say that "Yang Shen" has established the status of the top five gods in dreaming. Even if we make an inventory of the whole online history, it is difficult to fall out of the top five, relying on a "Yang Shen" and a "Buddha Ben".

"Jiu Ding Ji" is the low point of tomatoes, not the data such as ordering, but the influence. There were Star Change and Panlong before, then Swallow the Starry Sky and The Age of Wilderness. The influence of Jiu Ding Ji is far less than these four. Of course, Jiu Ding Ji is limited by the theme and length. Compared with the fantastic fantasy world of Yang Shen, Jiu Ding Ji can only be regarded as "martial arts". Anyway, I eat tomatoes, and the influence is hard to dream about in the turn of 2009-10.

However, when we open Jiu Ding Ji, we will find that it has more than 50 million hits (author’s note: it broke 50 million during the serialization period) and nearly 4 million recommended votes. When I was writing "Swallowing the Starry Sky" while eating tomatoes, it was reported that The Jiu Ding Ji had a high order of 40,000, and even broke the record of Panlong in some aspects. This allows us to see the elegance of PC e-subscription. Even if it is a trough, it is enough to shock the pack. In any case, the dispute between "Yang Shen" and "Jiu Ding Ji" is almost the most dazzling confrontation in the history of online writing. Its significance and exposed problems:

1. Establish the status of a super-top god in the dream machine.

2. It shows the prosperous charm of dominating the world at that time.

3. Exposed the problems of brushing tickets at the starting point, even conniving at brushing tickets. In the following five years or even longer, brushing has become the starting point of stubborn tinea.

4, dream into god machine after the "Yang Shen" run away, began to expose the starting point of prosperity under the scar …

(Part of this article is taken from Encyclopedia and Dragon Sky Post, originally published in Dragon Sky Forum, http://www.lkong.net/thread-1385927-1-1.html The Paper, and reproduced with authorization. )