Shi Qing, Jason Lu: A Judicial Case Study of Typical Labor Disputes in China Sharing Economic Platform

Original Jason Lu Shiqing Shanghai Law Society

Jason Lu, Vice President of Labor Law Research Association of Shanghai Law Society, Director and Chief Partner of Shanghai Jiangsanjiao Law Firm.

Shi Qing, lawyer of Shanghai Jiangsanjiao Law Firm.

synopsis

A major feature of the sharing economy is to mobilize and match service providers through the big data mining of platform enterprises’ demand for consumers. As a result, the working time and space conditions in the sense of past labor relations have been diluted, and it is difficult for a large number of service providers to seek treatment and relief under them. Taking representative cases as samples, this paper makes a subtle analysis of the power structure of employers and employees in platform enterprises in different industries, and finds that although the contractual relationship between the two parties is different from the legal relationship model of labor relations in the past, the management of platform enterprises is actually strengthened. This reinforcement is embodied in ten aspects, such as deposit/deposit, training and attendance, remuneration payment, service provision, assessment and punishment, rewards and subsidies, collection and use of personal information, ownership of intellectual property rights, exclusion of competition and risk outsourcing. All kinds of social subjects in the risk control end, the labor-capital game end and the system design end are in their proper positions, which is a possible way to solve the systemic risk.

Keywords: sharing economy, digital labor, labor disputes, labor relations

I. Background

(A) the sharing economy in recent years: the momentum is rapid, and labor disputes have emerged.

Since 2012, with the emergence of "Didi taxi", the sharing economy has gradually entered the stage of Chinese economic history. Since then, in addition to e-commerce, mobile payment, audio sharing, online rental and bike-sharing have followed. In 2015, it was called "the first year of sharing economy". The sharing economy began to cover all aspects of social life, and services such as driving, housekeeping, beauty, hairdressing, cooking, and daily necessities maintenance became Internet-based.

A major feature of the sharing economy operation model is that at the application level, platform enterprises mobilize and match service providers through big data mining of "information platforms". This new employment mode has realized the digitalization and informationization of business information, work instructions, fund settlement and market evaluation, and the working time and space conditions in the past sense have been diluted.

Therefore, issues such as the protection of the rights and interests of service providers have gradually emerged, and related disputes have begun to arise. These disputes include not only individual disputes between the anchor of the live broadcast platform and domestic service personnel, but also group disputes such as online freight drivers and take-away riders.

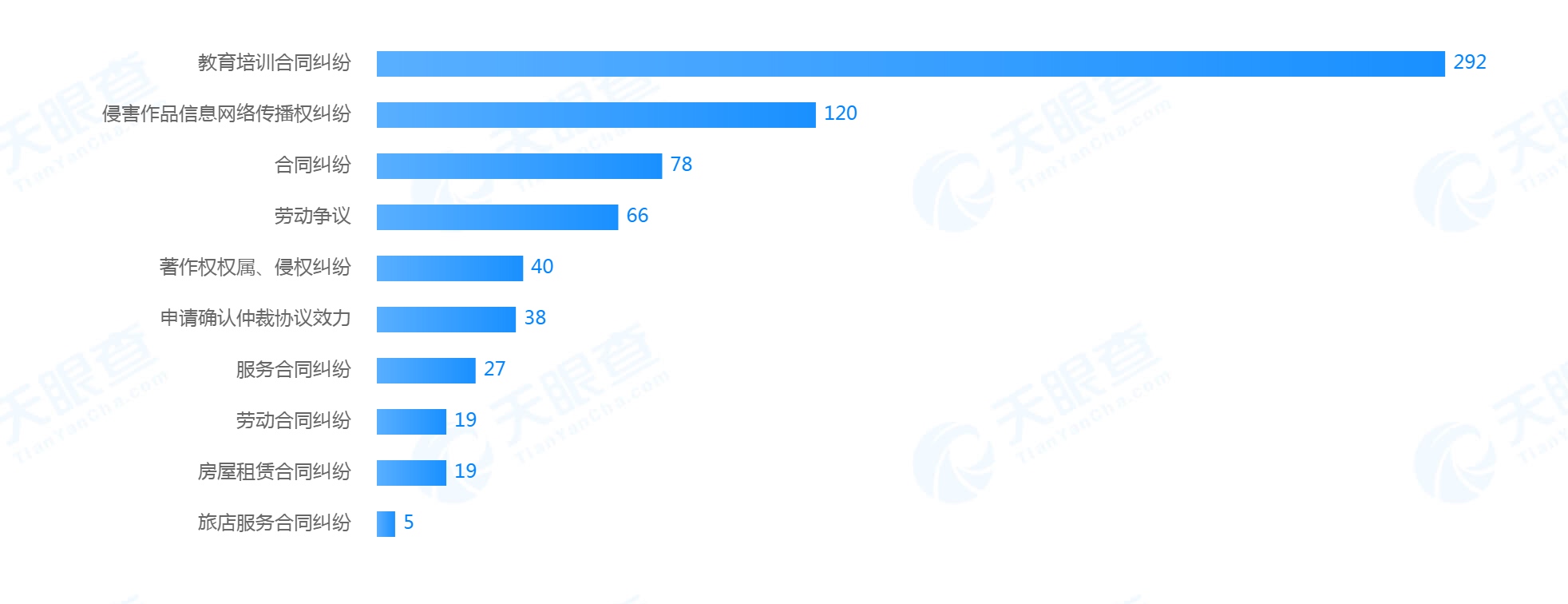

In April 2018, Beijing Chaoyang Court analyzed 188 labor dispute cases of Internet platform enterprises tried from 2015 to the first quarter of 2018. In addition, the courts in Shanghai and Jiangsu have also published the gist of the relevant cases through the official media. China is exploring the legal issues of employment in platform enterprises.

(B) Labor relations in digital labor: from "ism" to "problems"

There is a long-standing dispute about the identification of labor relations under the platform of sharing economy (Internet platform). In 2014-2015, the practitioners, including government officials, judges and lawyers, almost overwhelmingly believed that in the context of the country’s vigorous development of the "internet plus", the external employment in the sharing economy should apply a more relaxed labor relations identification standard. Only some labor law scholars suggest that we should learn from the experience of Germany, Italy and Japan to avoid the situation of "marginal people without basic salary, unnecessary expense reimbursement, social security, high turnover rate and no economic compensation". With the expansion of the scope of the dispute, practical and theoretical research has gradually deepened. Sociologists began to use the method of field investigation to study the service providers’ professional psychology, and labor relations scholars also began to conduct quantitative research on the control of labor process by capital through internet technology. However, some network law scholars noticed the essence of the "illegal rise" of the sharing economy earlier, and continued to pay attention to the definition of property rights and the avoidance of responsibility in the integration of social resources from the two dimensions of digital labor and platform economy. These studies indicate that the understanding of the employment relationship in the sharing economic platform is gradually moving from an "ism" debate to a detailed and rational "technology" study. This paper selects several typical cases of sharing economic platform, and through the subtle analysis of the power structure of employers and employees behind the cases, reveals the logic behind the court decision, and puts forward some governance suggestions to expand the horizon to pay attention to the allocation of rights and obligations of various participants.

Second, the typical case and the representation of legal relationship

(1) Share typical cases of labor disputes on the economic platform

1. Zhang and Shanghai Lekuai Information Technology Co., Ltd. labor dispute case (chef case)

In this case, the defendant company operates an APP called "Good Chef", which can make online appointments for chefs to provide cooking services. The plaintiff, on the other hand, is an "online contract chef", who is dissatisfied with the company’s "stop paying wages" and appealed to arbitration, demanding that the two parties be confirmed as a labor relationship rather than a contractual "cooperative relationship", and that the company pay double wages, overtime pay, illegal termination of labor compensation, etc. After arbitration, first instance and second instance, the court of second instance finally confirmed the labor relationship between the two parties and supported their claim for economic compensation.

2. Liu v. Tianjin Wubadaojia Life Service Co., Ltd. (manicurist case)

In this case, the plaintiff signed a contract to settle in the beautiful APP platform operated by the defendant and signed the "58 Home Service Agreement". Later, the plaintiff unilaterally terminated the labor contract because the defendant did not pay social insurance and did not pay labor remuneration in full, and appealed to arbitration for confirmation of labor relations and payment of corresponding compensation. In this case, the plaintiff did not confirm the labor relationship because of the lack of proof submitted by the defendant to prove his management.

3. Xue Mou et al. v. Shanghai Shenzhou Huadong Car Rental Co., Ltd. and other motor vehicle traffic accident liability dispute case (car driver case)

At the same time, this case involves the network car driver, the network car platform company (Shenzhou company), the outsourcing company and the infringed party. Xue was injured by Shimou, the driver of Zhaoshi, who was a formal employee of the outsourcing company at the time of the accident and was performing the operation business distributed by the network car platform company. In addition, the accident vehicle is a non-operating vehicle registered under the name of the network car platform company. Subsequently, Xue sued Shimou, the platform company and the outsourcing company to the court. Because the court of first instance only found that Shimou had a labor relationship with the outsourcing company, it ruled that the outsourcing company was liable for compensation other than traffic compulsory insurance, while the network car platform company was not liable for the employer. Xue appealed to the network car platform company and the outsourcing company to bear joint liability. The court of second instance supported its claim.

4. He and Shanghai Panda Mutual Entertainment Culture Co., Ltd. confirmed the labor relations dispute appeal case (anchor case). The plaintiff in this case was a game anchor who settled in the defendant’s live broadcast network platform company and signed an exclusive cooperation agreement with the defendant. Because the plaintiff believed that the two parties were in a labor relationship, he filed a labor arbitration to determine the relationship, and the defendant paid double wages for the unsigned labor contract. After arbitration, first instance and second instance, the court finally failed to support its request.

5. Li and Beijing Tongcheng Bing Technology Co., Ltd. confirmed the labor relations dispute case (flash courier case)

In this case, Li, a flasher, had a traffic accident when he was engaged in the flasher business. In order to enjoy the treatment of work-related injury insurance, he sued the operator of the "flasher" platform to the court to confirm the existence of labor relations between the two parties. The key to this case is that the court broke through the business scope of the platform company and determined that it actually provided cargo transportation business, and then confirmed the labor relationship between the two parties through the judgment elements of labor relations.

(B) Representation: a legal relationship model different from previous labor relations.

It is worth noting that although the chef case and the flash courier case have confirmed the labor relationship between the two parties, they are still relatively few in all similar cases. In the current labor dispute cases of the sharing economic platform, the sharing economic platform almost invariably refuses to recognize the labor relationship with the service provider, while the court mainly examines the subject nature, management behavior, remuneration payment and business subordination according to the Notice on Establishing Labor Relations issued by the Ministry of Labor and Social Security in 2005. Accordingly, the legal relationship model of sharing economic platform presents the following four characteristics which are different from those of previous labor relations.

1. "Bring your own dry food" practitioners

"Bring your own dry food" means that service providers may complete their tasks with their own work materials and ability. Internet platforms only provide business information and settlement support, and services are provided without the cooperation of other practitioners. The combination of labor relations is that employees must be attached to the employer and complete their work with the cooperation of other workers under the organization of the employer.

2. The business nature of "lump sum"

In the past identification of labor relations, the employers or organizations of employees often mastered the internal standards and external pricing of the products they produced, and supervised the industry access and the implementation of industry standards. However, at least in the early days, the sharing economy platform often does not regulate the access of practitioners, service standards and pricing. Some platforms even allow practitioners to get paid directly from customers, and practitioners are almost "all-in" self-employed. Of course, the internal and external responsibilities caused by them are also borne by practitioners.

3. Platform enterprises whose business scope is inconsistent with the business purpose.

Practitioners obtain service information from the Internet platform, but the Internet platform does not recognize the enjoyment of labor results. Platform enterprises often claim that they are actually engaged in the development and operation of application software and the integration and push of service information, and do not directly operate physical business. Therefore, there is a big gap between the labor of practitioners and the business scope of Internet platforms.

4. Weakened subordination

The subordination here is manifested in three levels:

First, the weakening of working time and space means that practitioners may have the autonomy to decide whether to work, working hours and even working forms, and are no longer on full-time standby and working. You only need a mobile phone to work all over the world.

Second, the attribute of task management is weakened, that is, the so-called grabbing orders instead of dispatching orders. After customers input consumption information into the Internet platform or the Internet platform to collect consumption information, they share the information in the practitioners’ terminals, and the practitioners choose to provide services or compete according to standards such as time sequence and distance, and the winners of the competition complete the consumption services.

Third, the core interests are weakened from the attributes, as shown in the second point.

Third, platform enterprises: the agreement excludes identification and actually strengthens management.

(1) Deposit/security deposit

Platform enterprises often collect deposits from service providers. The role of the deposit seems obvious, that is, the use fee of the means of production: for example, in the chef case, the platform enterprise said that the deposit was "the rental fee for providing chef’s clothes and cooking utensils, and it would be returned when the items were returned". In addition, some platforms also charge a deposit for transactions. For example, in a case of a manicurist service platform, the platform enterprise agreed that a manicurist should use the platform to obtain service order information, and should pay the deposit to the platform.

However, the use of this deposit/margin is often intertwined with the functions of other platform enterprises. The production materials provided by the platform enterprises are accompanied by the platform logo, and the obligation to pay the deposit/deposit actually constitutes the propaganda obligation of the service provider and the platform packaging of the platform to the service provider. The deposit/security deposit is also used to deduct the share drawn by the platform enterprise from the service fee, and the platform enterprise can also deduct the cost of using the means of production by the service provider from the remuneration it receives. In addition, some platform enterprises will also use the deposit as a weight to retain service providers when they are restructured, such as stipulating that "resignation within six months will not be refunded, resignation within six months to one year will be refunded by half, and full refund will be made after one year".

(2) Training and attendance

Also based on the requirements of standardized services and the consideration of platform packaging, platform enterprises often conduct pre-job training. For example, in the case of manicurist, platform enterprises require to participate in standardized training for services according to the order service standards formulated by them during the trial period. According to the manicurist, the training content includes nail technology, service process, how to use the beautiful APP platform and how to serve customers, etc., and there is income during the training period.

In addition, platform enterprises are not without attendance requirements. In the chef’s case, the chef said that he had to report to the office and dispatch station of the company’s management staff at 10: 00 in the morning, and he had to report here at 18: 30 in the evening, in the form of punching in, and his salary would be deducted if he was late. In the manicurist case, the manicurist also said that the platform enterprise stipulated the manicurist’s rest time in the APP platform, and there were four days’ rest in a month. The leave had to go through the platform, and he had to call the team leader appointed by the platform enterprise, and the team leader could rest only after applying for approval.

(3) Payment of remuneration

As the core point of determining the legal relationship between the two parties, remuneration payment needs special attention. Under the background of revenue sharing, platform enterprises often master pricing, control distribution and issue fixed "bonuses" on a monthly basis, but legally exclude monthly remuneration as the qualitative nature of wages.

1. Revenue sharing model

The compensation distribution mode between platform enterprises and service providers can be divided into two types according to whether the platform enterprises draw from it. In the case that the platform enterprises do not draw, the main business purpose is to collect information from the supply and demand sides, and the profit point is mostly advertising fees; In the case of platform enterprises, the profit point has shifted. In the case of the chef, the platform enterprise provides the chef with the above two revenue sharing methods, and the chef chooses the second one, that is, he not only accepts the door-to-door cooking service appointed by customers through the platform, but also is willing to accept the door-to-door cooking service appointed and dispatched by Party A.. At this time, the customer’s service fee is allocated by both parties, and the platform pays the chef’s expenses caused by scheduling. In the manicurist case, both parties agreed that the information service fee collected by the platform was 20% of the monthly service fee collected by the platform.

2. Pricing power of services

On the surface, self-employed people should enjoy the right to price the services they provide, including the right to decide the initial price and the right to adjust the price according to the objective situation or customer requirements in the actual service process. However, in practice, platform enterprises tend to firmly control the price agreed by both parties on the platform to prevent breach of contract or fraud from damaging the interests of the platform. For example, in the case of the chef, the platform enterprise agreed that the service price of the chef should not be modified without authorization once it is released. If the service price is changed to the reserved customer without authorization in violation of the regulations, the platform enterprise has the right to immediately terminate its cooperation relationship and demand compensation for the corresponding losses.

3. Settlement object

That is, whether the fees paid by customers are paid directly to the service provider or through the platform. In the case of manicurists, the platform claims that the income of manicurists comes from the service fees paid by manicurists in cash (that is, offline) or online. However, in its agreement with manicurists, it is written that the manicurists use the information services provided by the platform. After the trial period expires, the platform enterprises should be fully entrusted to collect and manage the service payment for orders on their behalf. At the time of settlement, the platform enterprise has the right to deduct the information service fee that the service provider should pay to the platform. In the case of Chef, the platform enterprise also recognized that the money received by the service provider was the cooperation fee paid by the platform enterprise as an intermediary platform after collecting the service payment from consumers.

4. The nature, standard and settlement cycle of remuneration

Platform enterprises often do not recognize the remuneration as wages, but recognize the remuneration as a "package income" mainly based on "incentive bonus". For example, in the case of the manicurist, although the platform enterprise advocates that the service provider’s labor remuneration on the platform comes from the service fee paid by the customers who receive nail services, it also agrees that the service provider can earn no less than 10,000 yuan per month (including meal supplement, order incentive bonus and other rewards that can be obtained according to the platform incentive policy) on the premise that the service provider abides by the relevant agreements. In the case of the chef, the platform enterprise claims that the remuneration paid is the cooperation fee including the over-single reward. In the anchor case, the two parties agreed that if the anchor reaches the minimum monthly live broadcast days, monthly average daily live broadcast times and monthly live broadcast duration, it will receive RMB 7,000. However, although the platform enterprises have agreed on a series of conditions for the payment of remuneration, they are still paid on a fixed monthly basis when actually paying.

(4) Provision of services

Corresponding to remuneration payment is service provision. In the process of service provision, platform enterprises often strictly control the service provider, the time and place of service, the right to choose and refuse.

1. Personal exclusivity

First of all, consistent with the agreements on publishing, performance and technology development, the service provider must provide services by himself, showing strong personal specificity. For example, the entry agreement of a live broadcast platform stipulates that "without the written consent of the platform, it is not allowed to directly or indirectly or in any way complete the live broadcast content agreed in this agreement by itself or entrust a third party", and once it is violated, the platform has the right to immediately terminate the contract and take the unpaid webcast fee as liquidated damages. If the amount of liquidated damages is still insufficient to compensate for the loss of the platform, the service provider should also make supplementary compensation.

2. Time and place of service

For the on-site service requirements put forward by customers, platform enterprises often require service providers to arrive at the service location on time. In the case of chef, if the platform enterprise agreed that the customer would make an appointment for home cooking to the service provider through the platform, the service provider should arrive at the service place to provide cooking service for the customer within the time agreed by the customer. In the manicurist case, if the service provider fails to arrive at the service location required by the customer on time, the platform has the right to punish until the cooperation relationship is terminated.

3. The right to choose and refuse services

Does the service provider have the right to choose customers? Under the mode of grabbing orders, service providers certainly have the right to choose customers, although the result of selection is uncertain. However, in the delivery mode, customers place orders online through APP software, and platform enterprises will give priority to pushing a service provider according to the geographical location of the service provider. At this time, the service provider will lose the right to choose.

So in this case, does the service provider have the right to refuse? This has become the main concern of judges and both parties in the identification of labor relations in platform enterprises. For example, in the chef case, if the court asks this question in court, the platform enterprise can refuse the answer, but it will affect the good award. If the service provider has no time, the platform enterprise can arrange others, but it needs to consult the customer in advance whether to accept or withdraw the order; The chef advocates that you can’t refuse to take orders, and if you refuse, you will deduct your salary. There are similar opposing views in the manicurist case.

(5) Supervision, assessment and punishment

Based on the comprehensive interests of platform enterprises and service providers, they often supervise and assess service providers and give corresponding disciplinary measures. For example, in the format agreement for the live broadcast of a platform, it is stipulated that platform enterprises have the right to formulate platform operation system and management rules for anchors, manage and supervise anchors, and have the right to adjust or change corresponding rules according to operation conditions, and the anchors understand and agree with this; In addition, the platform also has the right to inspect and judge the anchor, so as to establish (cancel) the reward or punishment for the anchor. The specific inspection items and standards shall be formulated separately by the platform, without the additional consent of the anchor.

In the manicurist case, the platform enterprise not only has assessment, but also has irregular disciplinary system: during the validity of the agreement, the platform has the right to assess the service providers irregularly, and has the right to classify the enjoyment level of order information services according to the assessment results and formulate information service policies and related systems during the assessment period. If the service fails to satisfy the customer and the customer complains, the platform has the right to impose a scoring disciplinary system on the manicurist. If the customer scores a certain number of bad reviews or complaints, the platform has the right to terminate the cooperative relationship with the manicurist and ask Party B to compensate the corresponding losses.

(6) Awards and subsidies

The reward and subsidy system of platform enterprises has also become an important incentive to attract service providers to register. For example, in the manicurist case, platform enterprises will pay subsidies according to the amount of bills, the amount of bills and customer evaluation. At the same time, however, platform enterprises also stipulate that "in order to adapt to the changing market policies and situation, the platform has the right to introduce certain incentive policies such as transportation subsidies and incentive bonuses from time to time, but service providers do not have the right to demand compensation, compensation or claim such subsidies, bonuses and other incentive funds in any way", which limits the right of service providers to claim them as wages. In the online live broadcast industry, where the gifteconomy is the most widely used, the service provider obtains the benefits by obtaining the virtual props donated by the users according to the exchange rules and sharing ratio formulated by the platform, and the rewards are directly linked to the customer evaluation (gifts).

(7) Collection and use of personal information

The transfer of personal information of service providers is also worthy of attention. In fact, as an important asset of platform enterprises, the acquisition of personal information of service providers is an inevitable requirement of platform brand promotion. In the settlement agreement of the live broadcast platform, it is often stipulated that the platform has the right to use the anchor’s name (including but not limited to your real name, pen name, screen name, previous name and any character symbol representing your identity) and portrait (including but not limited to real portrait and cartoon portrait, etc.) for all kinds of publicity. In the case of the chef, the two parties agreed that the chef "knows and agrees to provide some private information such as his own identity information and contact information to the platform and publish it", and at the same time "knows and agrees that the price corresponding to the cooking service he provides will be published and published by the platform. On the other hand, some platforms also take the publicity and promotion of service providers as a service. For example, in the case of manicurists, the platform will manage and display personal information and order service information for manicurists, and will push and promote them as "value-added services".

(8) Ownership of intellectual property rights

In the case that the provision of services will produce intellectual property rights, platform enterprises often determine their ownership through agreements. For example, it is stipulated in the agreement of a live broadcast platform that all intellectual property rights (including but not limited to intellectual property rights such as copyright and trademark rights and all related derivative rights), ownership and related rights of all achievements (including but not limited to commentary videos and audio, and any words, videos and audio related to the matters in this agreement) generated by the service provider during the live webcast of the platform shall be enjoyed by the platform enterprise. All this is free and unlimited. Without the written consent of the platform, the anchor shall not use or provide or authorize any third party in any way and obtain any income.

(9) Eliminate competition

On the basis of determining the rights, the platform enterprises will request to exclude the possibility of any competition among service providers. For example, in the anchor case, it is stipulated in the live broadcast agreement between the two parties: the anchor agrees to use the live broadcast platform as an exclusive platform for live internet sharing, and He promises not to share the live broadcast on any third-party internet platform outside the platform without the written consent of the platform during the cooperation period. The anchor shall not broadcast live games outside the scope specified or recognized by the platform, and shall not broadcast live in the name of non-platform recognition; Without the prior written consent of the platform, no non-platform product introduction is allowed; Do not undertake any commercial activities of any competitive platform during the agreement period, and do not upload the video uploaded to the platform directly or through a third party to the competitive platform.

It is worth noting that, despite a slight lack of supervision, some sharing economic platforms based on manual labor will still agree with service providers on "excluding competition" clauses. In the case of flash courier, the two parties agreed that "couriers should not provide services for other platforms at the same time", which eventually led to the court’s decision to confirm labor relations to some extent.

(X) Risk outsourcing

Even with the above-mentioned behaviors, platform enterprises often think that service providers are self-employed people at their own risk and should guarantee their services for defects. In both the manicurist case and the chef case, the platform pleaded that "the service provider is a freelancer who provides services to customers with his own skills at his own risk". The live broadcast platform also stipulates a "safeharbour" exemption: if the anchor results contain other people’s intellectual property rights, portrait rights, name rights or other legitimate rights and interests, it should ensure that the legal authorization of the relevant rights holders has been obtained, and it has the right to authorize the platform to be used permanently and free of geographical restrictions; In case of violation of the regulations, the platform has the right to require the anchor payment platform to pay the relevant fees to the other party by itself or by entrusting a third party, and deduct them from the webcast fee of the anchor in equal amount, and the insufficient part of the anchor should be supplemented; If the platform suffers any economic and reputational losses, the anchor shall make full compensation and be responsible for eliminating the adverse effects.

Another typical method of transferring risks is outsourcing. In the case of traffic accidents of car drivers, platform enterprises try to avoid the possibility of being liable to employers because of the car drivers’ job behavior by letting them sign labor contracts with outsourcing companies. Platform enterprises believe that according to Road traffic accident responsibility confirmation, the cause of the accident is improper operation of the driver, not the vehicle itself involved, and the platform enterprise is only the owner of the vehicle and there is no fault, so it should not bear any responsibility; The outsourcing company, which is also a wholly-owned subsidiary of the platform enterprise, voluntarily assumes the responsibility beyond the insurance scope. For the internet catering platform, it has become normal to outsource the labor relations of food delivery staff to other companies.

It should be noted that based on the business logic of sharing economic platform, although most of its management measures can be attributed to the above ten points, not all of them are applicable to a certain platform. For example, some platforms do not necessarily require service providers to provide guarantees, and some platforms do not necessarily restrict the competition of service providers or emphasize the ownership of intellectual property rights.

Nevertheless, it is still necessary to consider whether controlling one point or several points can actually lead to global control in management in the process of realizing commercial purposes of platform enterprises. For example, even if there are requirements for the anchor to get paid, such as the minimum number of days of monthly live broadcast (15 days), the average number of people per month (3,000 people per day) and the length of time (80 hours), such restrictions undoubtedly rule out any possibility that the anchor can use his major to do the same or similar work during the service period. You don’t just need a mobile phone to work all over the world at any time; But even if you only need a mobile phone, you must work on this platform every day. This leverage effect on the control of service providers is particularly worthy of attention under the background of the obvious trend of oligopoly pattern in various industries.

Fourth, the turn of the court: weighing the protection of rights and interests and sharing economic development

In the case of confirming labor relations, the judge first considers whether the individual has personal and organizational subordination, that is, how many "management privileges" the platform enterprises have.

For example, in the manicurist case, the reasons why the court found that the two sides did not belong to labor relations included:

(1) It is agreed by both parties that manicurists can choose their own working hours and working places, and there is no need to work in shifts, and there is no special and fixed office space;

(2) Both parties agree that the settlement method of the service fee includes online payment by the customer, which is paid to the manicurist on a monthly basis after deducting the information service fee from the platform, or the customer pays the manicurist directly in cash, so the income of the manicurist is composed of the customer service fee rather than paid labor arranged by the platform enterprise;

(3) The business scope of the platform enterprise is the collection and release of business supply information, excluding the operation of manicure business, so the manicure service provided by manicurists is not a part of the platform enterprise.

However, in the case of 2018, the author saw the turn of some local courts, especially Beijing courts. Its turn mainly considers the fairness of rights protection, the consistency of rights and obligations and the anti-risk ability of the contending subject.

(1) Fairness

In fact, behind fairness is the ranking of values worthy of national protection. For example, when it comes to citizens’ basic rights, such as labor safety and health, citizens’ health rights, etc., the court will tend to protect the disadvantaged party in the dispute. However, the court will treat it with caution if it involves demands such as double wages for unsigned labor contracts. For example, in the chef case, although the court found that the subordinate relationship between the two parties conforms to the essential characteristics of labor relations, at the same time, based on the signed Cooperation Agreement, the relevant labor rights and interests of the chef were legally guaranteed, so the service provider’s claim of double wage difference without signing a written labor contract was not supported.

(2) Consistency of rights and obligations

In addition to fairness, courts sometimes consider the consistency of rights and obligations of platform enterprises. For example, in the driver’s case, the court held that the vehicle was owned by the platform company, and the platform company also insured it. After the incident, the insurance company assumed the responsibility of claim settlement, and the original judgment found that the platform company did not assume the responsibility of claim settlement, which was inconsistent with law and reason; Moreover, the driver of the special car drives the vehicle of the platform company to operate according to the instructions of the platform company, and the car calling service and the payment of the fare of the relevant special car are operated through the platform company, and the proceeds also belong to the platform company. Since the platform company enjoys the rights, it should bear the corresponding liability for compensation.

In the case of flash courier, the judge even pointed out that platform enterprises should not bear the legal and social responsibilities they should bear because they have adopted new technical means and new business methods.

(3) Ability to resist risks

The application of anti-risk ability first appears in the distribution of burden of proof. For example, in the chef case, the court held that the platform company, as a network company, has the ability and obligation to prove the details of the "cooperation" between its company and the chef under the business model with the mobile Internet as the background, so as to prove that the "cooperation" process between the two parties fully conforms to the terms stipulated in its cooperation agreement. Although the platform company claims that the remuneration paid to chefs on the 15th of each month is cooperation fees such as over-the-counter rewards, not wages, as the remuneration issuer, it has not provided evidence to prove the calculation details and specific basis for paying chefs’ remuneration, nor has it provided evidence to prove that the "Good Chef" platform reward policy has been delivered to the chefs or reached an agreement with them, so it should be considered that this fee is the nature of wages.

In addition, the judgment standard of anti-risk ability is also directly reflected in the system design of labor management. In the case of flash courier, the judge held that as a company operating by using new technical means, it can fully use the advantages of information technology to realize legal operation and management. The court cannot refuse to provide basic rights relief to workers because the relevant supporting system is not perfect. Therefore, the responsibility of reducing employment risks is directly assigned to the enterprises sharing the economic platform.

V. Jiang Triangle Viewpoint: The governance of labor disputes in the sharing economy requires the social subjects to "take their places".

However, the turn of the above courts is only a very small number in the current overall judicial decisions. Based on the local court’s consideration of the local political and economic environment and many other subjective and objective reasons, it is still difficult for the system implementation end to make long-term considerations such as the case of flash courier. Therefore, the author believes that in the management of labor disputes in the sharing economy, we should broaden our horizons to pay attention to the distribution of rights and obligations of various participants, which is mainly reflected in risk control, labor-capital game and system design.

(1) Risk control end

The prevention of disputes within enterprises is the main barrier to control risks, but nowadays platform enterprises generally fail to completely exhaust the existing labor system subjectively or objectively. Positive cases, such as an Internet electronic equipment maintenance platform, also encountered many personnel management confusion problems that start-up Internet companies often encountered when it was established in 2015. After systematic employment design, through outsourcing relationship, labour relation, labor dispatch relationship, and applying for special working hours under standard labor relations, the risk management and control of employment in Internet platform enterprises are completed. The systematic design of employment mode not only gives service providers a sense of belonging, but also curbs the current situation of service providers "taking private jobs", thus achieving a win-win situation between labor and capital, making this enterprise one of the few industry unicorns.

(B) Labor-capital game end

Another reason for frequent labor disputes in platform enterprises is the lack of collective organization and collective bargaining. A positive case, for example, in Shanghai in early 2018, the first online food delivery industry trade union in China-Putuo District Online Food Delivery Industry Trade Union Federation was established. There are five online food delivery workers’ unions established in Putuo District, and more than 400 online food delivery workers have joined the unions. In addition, the advantage of Internet economy lies in the perfect evaluation system, and the ubiquitous digital labor is providing channels for civil supervision. For example, the Shanghai Food and Drug Administration has piloted an internal reporting system for take-away food delivery staff, encouraging more than 30,000 take-away food delivery staff in Shanghai to find and report the problem merchants on the online ordering platform at the first time. This system, to some extent, shares the regulatory responsibility of platform enterprises.

(3) System design end

A typical case of system design is the Interim Measures for the Administration of Online Booking Taxi Operating Services jointly issued by the Ministry of Industry and Information Technology and the Ministry of Communications in 2016. This method provides detailed regulations on the network car platform company, vehicles and drivers of the network car, and the management behavior of the network car, which largely regulates the benefit distribution of the network car industry in China and affects its development pattern. However, in other industries, the value distribution link of the sharing economy has been seriously neglected, and the corresponding system design is extremely lacking. To understand the value distribution state of sharing economy, firstly, it is necessary to comprehensively analyze the temporal and spatial pedigree of digital labor, and secondly, it is necessary to analyze the formation and development model of sharing economy platform. In addition, what is special for China is that the Internet economy (or digital economy) and the network security problems it brings almost coincide with globalization. A major feature of its business model is to break through the boundaries of the atomic world (national boundaries). In this bit world, the global ecology of digital economy industry and the flow of value chain are equally worthy of attention.

In recent years, the global Internet economy has developed rapidly, and it has continuously impacted a country’s existing systems such as competition law, copyright law, privacy law, labor and employment law. The platform economy lies in the development mode of Internet enterprises, and its risks are often accompanied by huge benefits. On the other hand, Internet companies in China are constantly going abroad, and some of them have even become a model for a country to learn from. Therefore, China should take the lead in controlling the systemic risks of the whole society that may be caused by Internet platform enterprises, and China Internet enterprises should take the corresponding social responsibilities.

Shanghai Law Society welcomes your contribution.

fxhgzh@vip.163.com

Related links

Source: Shanghai Law Research, Volume 15, 2019 (Labor Law Research Volume). Please indicate the source when quoting and reprinting.

Original title: "Jason Lu Shiqing: A Judicial Case Study of Typical Labor Disputes in China Sharing Economic Platform"

Read the original text