The legendary blockbuster year is coming. 2015 high-energy early warning handbook for new films in Europe and America

The so-called blockbusters, that is, mainstream commercial films with high investment and large production, often cover the best sci-fi movies and action blockbusters in a year, the most dazzling visual effects, the hottest movie topics, the most brain-opening dream trip, and the highest box office record of the year. These films will be born.

Science fiction new work team

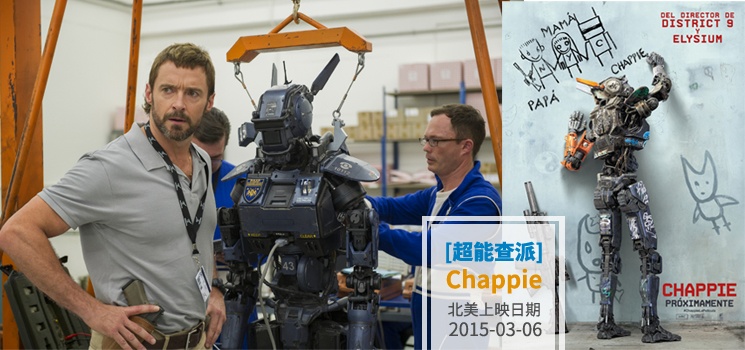

Chaoneng Chapai is a new sci-fi work by director neill blomkamp, whose debut novel "District 9" is a blockbuster. It is adapted from the director’s short film "Tetra Vaal" in 2004. It tells the story of a robot Chapai who was supposed to be a robot patrolman, was kidnapped by the bad guys, awakened himself, and had the ability to think and feel, which led to his self-growth This film is starring Dev Patel, Hugh Jackman and sigourney weaver, while Chapai is voiced by sharlto copley. According to the released trailer, the film keeps District 9’s sci-fi realistic style and adds elements such as graffiti growth to tell a fairy tale of a robot. [Please poke the trailer]

Disney’s latest sci-fi masterpiece "Tomorrow World", which is a theme park in various Disney parks, tells the story of a teenager who is curious about science and a talented inventor who is tired of the real world to start an extraordinary journey together to find the mysterious domain in their hearts: Tomorrow World. Directed by Brad Bird, the director of Mission Impossible 4, and starring George Clooney and the new generation actor Britt Robertson, this film previews the wonderful journey of entering tomorrow’s world with a tomorrow badge, which makes people look forward to it. [Please poke the trailer]

Although it experienced a storm of change of direction, as the opening work of Marvel Comics’s third stage, the comic "Ant Man" made its debut on the big screen, which is still full of expectations. This film tells the story of michael douglas’s first generation Ant Man and paul rudd’s second generation Ant Man inheriting the mantle and jointly saving the world. During the New Year’s Day, the film released a miniature trailer from the perspective of ants, which was very novel, and also released a preview. The full preview will be released on the 7th. [Please poke the preview]

"Dreadwind: The Battle of Pixels" is adapted from the short film "Pixels" of the same name in 2010. This film tells the story of aliens invading the earth and incarnating the classic game characters in the 1980s to attack new york City on a large scale. In desperation, Mayor new york asked adam sandler, the former champion of arcade, to organize a team of arcade players to fight against aliens. Classic arcade characters such as "Big Villain", "Pac-Man", "donkey kong" and "Tetris" in this film are full of nostalgia, which will definitely make the post-1980s generation feel full of memories. The trailer hasn’t been released yet, so you can watch the short film in 2010 first. [Please poke the short film]

Adapted from the comic book of the same name, "The New Fantastic Four" is the most "calm" one of the summer blockbusters in 2015. So far, no publicity materials have been exposed, except for a few innocuous studio photos, even a serious still has not been released, which is quite mysterious. Whether the lack of publicity will affect the box office of the film is worrying. The film is re-performed by a brand-new Cass. It is not clear whether the invisible woman played by kate mara, Mr. Wonder played by miles teller, Thunderbolt played by Michael B. Jordan and the stone man played by Jamie Bell can surprise the audience.

Jungle book, adapted from a novel of the same name, tells the story that human children raised by wolves grow up together with other animals. Directed by jon favreau, the director of Iron Man series, the film will be shot in a combination of real people and CG, and will include super-strong dubbing companies including Scarlett Johansson, bill murray, christopher walken, lupita nyongo and Ben Kingsley, and the leading actor "jungle book" will become the only real person in the film, starring neel sethi after a worldwide casting.

Best-selling sequel team

The highly anticipated "The Avengers 2" will be available in five months. In addition to the original powerful cass, Fast Silver played by Aaron Taylor-Johnson and scarlet witch played by Elizabeth Olsen are added, while Ultron, the villain, is voiced by James Spader, and his deputy, Vision, is played by paul bettany. As can be seen from the trailer exposed in October, the atmosphere of this sequel is darker than the previous one, and the superheroes are cornered by Ultron. The Hulk hides in the snow forest, the shield of the American team is shattered, and the black widow says, "Nothing lasts forever." The "anti-Hulk" armor appeared and shocked the Hulk. [Please poke the trailer]

"Mad Max: Fury Road" is the fourth sequel of Mad Max after nearly 30 years. It will use a brand-new card to tell a brand-new story, so there is no pressure to read the previous work. The film is still directed by george miller, the director of the first three films, and tells the story of Max played by Tom Hardy and Freosa played by Charlize Theron meeting in the desert and launching a road war in a world of only blood and fire. The yellow sand and the road war in the trailer are wild and full of expectations. [Please poke the trailer]

Jurassic World is the fourth sequel to Spielberg’s classic Jurassic Park, starring "Star-Lord" chris pratt. Judging from the trailer, compared with more than a decade ago, today’s special effects technology is changing with each passing day, and the visual effects will be more realistic. The door of Jurassic Park is opened again, and humans have created a genetically modified hybrid dinosaur D-Rex predator, and a catastrophe is just around the corner. [Please poke the trailer]

The Terminator: Genesis is the fifth film in the Terminator series, which is a restart of the previous film and tells the parallel world of the old version of time and space. Arnold Schwarzenegger starred again and joined the "Dragon Girl" Emilia Clarke and other popular movie stars. Everyone will never forget Schwarzenegger’s classic line "I will be back!" (I’ll be back! ), in the trailer, Schwarzenegger’s sentence "I have been waiting for you." (I’ve been waiting for you.), it almost made people cry. This episode is the first of a new trilogy, and the remaining two sequels will start shooting in 2016. [Please poke the trailer]

The 24th film of 007 series, officially named Spectre, will continue the story of the last film, but because the last film, Mrs. M, has passed away, James Bond’s boss will be Mallory played by Ralph Fiennes. Director sam mendes, starring daniel craig, will return, monica bellucci and Léa Seydoux will play the new bond girl, and the super-strong cass including christoph waltz, Ben Whishaw, naomie harris and Andrew Scott will be recruited. In the high-profile Sony hacking incident, the script of this film was stolen or illegally sold, which dealt a great blow to the secrecy of filming. I hope this film can be released on time after the storm.

The Hunger Games 3: Mockingbird I, which is being shown in North America, has been a hit at the box office since its release, and the final chapter to be released this year is naturally expected to be extremely high. As the end of the series, the grand revolution will reach its climax, and it will go out of the hunger game in the playground and become a battle for the whole people. Kate Nice, played by jennifer lawrence, becomes a mockingbird and becomes a revolutionary leader. It is also one of the suspense where she will lead the people who follow her, and how the three-year love triangle will end.

Star Wars fans’ long-awaited Star Wars 7 is finally coming, and the first preview has achieved 81 million hits, which set off fans’ expectations. This film tells the story of Star Wars 3 30 years later. It is directed by Jeffrey Jacob Abrams, the director of Star Trek series, and uses a newcomer to play the Star Wars card. In order to make the style of this film closer to the original Star Wars trilogy in 1970s and 1980s, the director not only insisted on shooting with 35MM film, but also made extensive use of models and live special effects, and even reopened the almost well-preserved 1977 Star Wars studio in Morocco, hoping to pursue the retro feeling of the picture with real shooting. The classic soundtrack of Star Wars was announced in advance, and the reappearance of classic elements excited the fans of Star Wars. The legendary spaceship Millennium Falcon took off to meet the imperial titanium fighter, which is a legendary reappearance. [Please poke the trailer]

As another longevity film series, Tom Cruise returned with Mission Impossible 5. After Mission Impossible 4 climbed the Burj Khalifa, Tom went into battle again to challenge the difficult moves. He scraped out of the A400M door of a military plane at a height of 1,500m, and Tom hung out of the plane flying at a speed of 400km/h for 20 minutes, which is the most thrilling action scene since the film. "Mission Impossible 5" was directed by Christopher McQuarrie, the director of "Knight Jack", and Zhang Jingchu, a China actress, joined in as the villain. The film will be released in North America at Christmas, and it will be full of enthusiasm with Star Wars 7.

Disaster action film squad

"Golden Agent" is adapted from the comic book of the same name, and tells the story of an ace agent who takes his nephew to the agent school and trains to become an ace agent of the British Empire. Starring colin firth, the British gentleman’s benchmark, is different from the previous spy movies, which drained adrenaline. From the preview poster to the stills of suits and ties, this film is full of elegant gentleman flavor, and there are also many hot action scenes and clever tricks that make people smile, which makes people look forward to it. [Please poke the trailer]

Dwayne Douglas Johnson’s new disaster action film "Doomsday Collapse" tells the story of an air force pilot flying to save a woman in a big earthquake across the United States. The advance notice was extremely shocking. An earthquake that began in California tore the whole United States apart. "Doomsday Collapse" is Dwayne Douglas Johnson’s third collaboration with director brad peyton. Director brad peyton said: "In the film, we will recreate an unprecedented earthquake scene in a densely populated area." [Please poke the trailer]

Code 47, based on the game of the same name, tells the story of a clone code 47 made by genetic engineering technology, who carries out assassination activities for a mysterious organization. Rupert friend plays the new killer 47. Compared with the 2007 version, what kind of breakthrough can be made is one of the highlights of the film.

The Last Witch Hunter tells the story that an immortal witch hunter is forced to join hands with a witch to prevent an evil witch gang in new york from releasing a plague that can destroy mankind. This film co-stars Vin Diesel, "Fire Kiss" Rose Leslie and Elijah Wood. Judging from the stills released so far, Vin Diesel has broken through the image of a capable macho man, and his beard is dirty and braided.